A Review of 2021 and Expectations for the Coming Year

By: Bill Shopoff, President and CEO, Shopoff Realty Investments

This past year has been quite interesting. There have been starts and stops, but overall, we continue to have a great economic recovery from what is now the shortest, and one of the deepest, recessions in history. Even with these fiscal improvements, we continue to deal with COVID-19, where the approval and implementation of vaccinations has brought hope and promise, against the impact and effect of the Delta and Omicron variants. It appears there is a high degree of resilience amongst all of us, as we work to manage our personal and professional lives, and I am encouraged by the fact that ultimately, we will emerge from this pandemic and move into a brighter future.

2021 brought back some degree of normalcy, albeit on a restrained basis. We have returned to business travel and attending conferences in person. In fact, we hosted about 50 of our financial services advisors and partners at a due diligence event in November in Newport Beach. It was a real pleasure seeing everyone in person and sharing an update of the firm’s activity, as well as upcoming investments.

One of the other items we spent much of 2021 tracking was tax legislation. As I write this letter, the final bill has not been approved, but it seems to be taking shape and is much less impactful to the investing public. It appears capital gain rates will remain unchanged and the ability to do 1031 Exchanges remains intact. This significantly watered-down bill, from what was originally presented, has added to the exuberance of the markets. In fact, the stock market has reached new highs and much of the real estate market has reacted in similar fashion.

We have seen significant recovery in our portfolio in terms of collections and values, with most assets returning to pre-COVID values and many of them seeing record high valuations. We were successful in selling a number of assets in 2021, with 9 dispositions, totaling nearly $70 million, and have several more set for closings in the first part of 2022. With these dispositions, we anticipate executing on our business plan which is making a distribution to the applicable partners in the near term.

One of the issues that we have encountered with our entitlement and development projects is the shortage of material and high commodity prices. Although prices for residential housing is at an all-time high, the residual value of our holdings has not been able to realize the full value of the price increases due to the higher material costs. We are hopeful that this will normalize over the next year, as supply chain issues are resolved.

Nevertheless, we have had several assets sold for values above our forecasts, and have many others teed up to go full-cycle in 2022, at values well above our forecasts.

As I sit here in early December, I am pleased to report that we have the largest pipeline of new, high-quality acquisitions anticipated to execute in early 2022 – over $700 million under review or under negotiations. I owe this to the quality of work that our team at Shopoff Realty Investments has done and is doing on a daily basis, and how that has attracted new institution relationships. We have been successful in closing repeat business with several of our existing institutional partners and have also added two new partners in 2021.

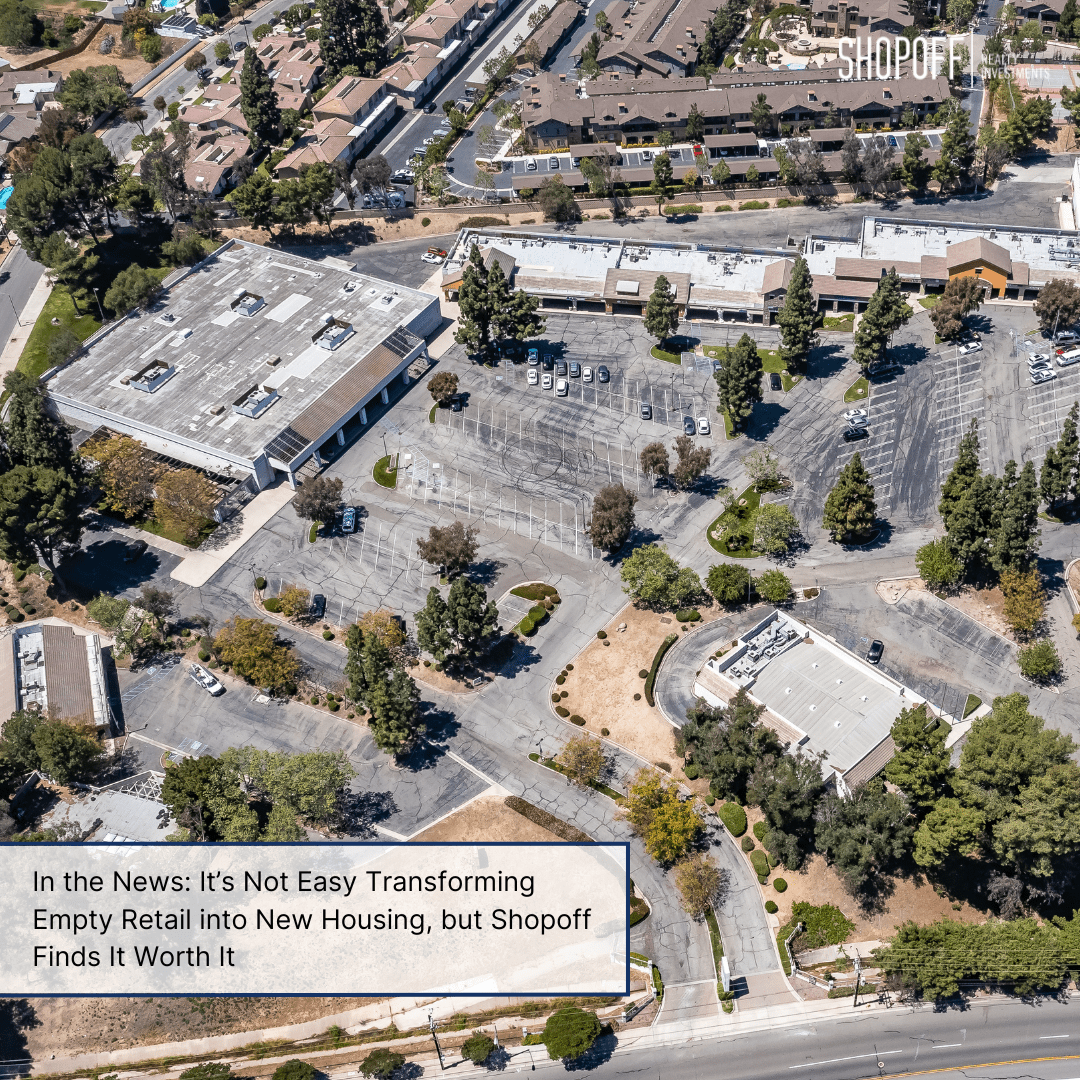

In addition, we have successfully grown our development business during the past year having broken ground on a variety of projects including Parkhouse Residences (30-unit luxury condominiums), Cierra Apartment Homes (60 multifamily units), I-10 Logistics Center (1.8 million square foot logistic center) and SolTerra (131 single family rental homes). These projects are all moving forward as scheduled and will be completed in the next two years. Additionally, we received approval for our Dream Las Vegas hotel project, which will begin construction in 2022.

I have been fortunate enough to run a successful business for the past three decades, a feat few are able to accomplish. 2022 will mark our 30th anniversary of the business we founded in 1992 in Austin, Texas. This could not have been accomplished without our stellar team, partners, and investors, as well as the unwavering support and efforts of my amazing wife and partner Cindy Shopoff. In addition to those that have been with us for many years, we were fortunate to have added several new employees over the last year who are helping us better execute our business each day.

For me, 2021 has been a year of gratitude. We have solved problems and emerged in top form to execute our investment strategy for the coming years. We are finding better investment opportunities and exercising better discipline which leads me to believe our best years are in front of us for both our investors and ourselves. We are looking forward to an incredible 2022, for our business, our investor partners, our valued team members, our country and the world, as we emerge from the pandemic and work together to build a better future.

The views, thoughts and opinions expressed in this outlook belong solely to the author. This outlook is based on current public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification.

About Shopoff Realty Investments

Shopoff Realty Investments is an Irvine, California-based real estate firm with a 29-year history of value-add and opportunistic investing across the United States. The company primarily focuses on proactively generating appreciation through the repositioning of commercial income-producing properties and the entitlement of land assets. The 29-year history includes operating as Asset Recovery Fund, Eastbridge Partners and Shopoff Realty Investments (formerly known as The Shopoff Group). Performance has varied in this time frame, with certain offerings generating losses. For additional information, please visit www.shopoff.com or call (844) 4-SHOPOFF.

Disclosures

This is not an offering to buy or sell any securities. Such offer may only be made through the offering’s memorandum to qualified purchasers. Any investment in Shopoff Realty Investments programs involves substantial risks and is suitable only for investors who have no need for liquidity and who can bear the loss of their entire investment. There is no assurance that any strategy will succeed to meet its investment objectives. The performance of former assets are not indicative of future results of other assets.

Securities offered through Shopoff Securities, Inc. member FINRA/SIPC, 2 Park Plaza, Suite 770, Irvine, CA 92614, (844) 4-SHOPOFF.