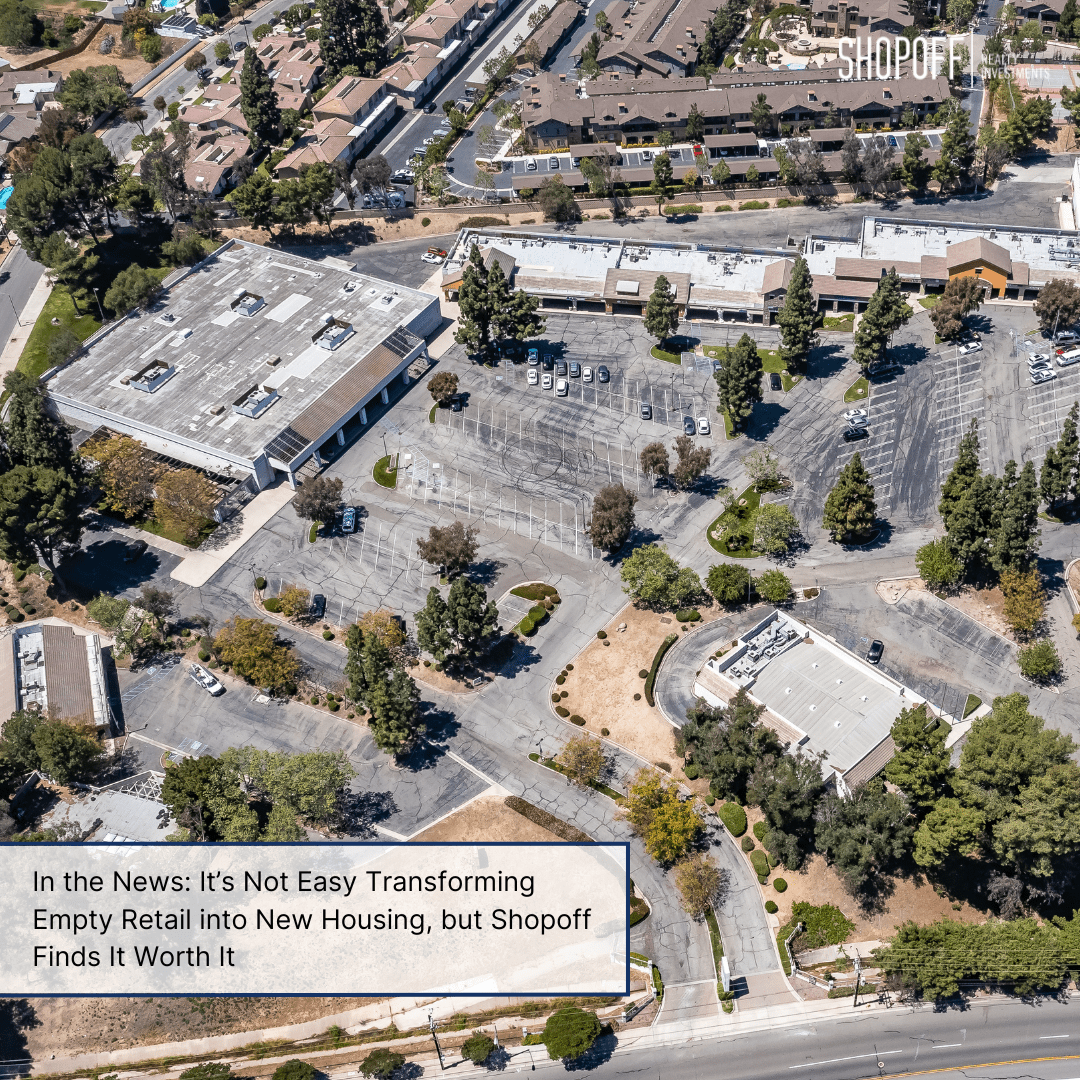

Pleasanton, CA – March 07, 2023 – Shopoff Realty Investments (“Shopoff”), Praelium Commercial Real Estate (“Praelium”), and an affiliate of Singerman Real Estate, LLC (“SRE”) announced today that the joint venture has acquired the former Nordstrom building located at the Stoneridge Mall in Pleasanton, California. The property totals 8.37 acres including the former department store’s parking lot.

“This asset represents an opportunity to acquire a significant piece of property in a highly desirable market in Northern California,” explained Shopoff President and CEO William Shopoff. “Our fourth mall purchase in recent years, we are looking forward to working with the city to repurpose this property and deliver much needed new housing and other uses for the community.”

Pleasanton is a suburban city outside of San Francisco, and the site is transit-oriented and within walking distance to the West Dublin Bart Transit Station, Workday Headquarters, Kaiser Permanente, and employment centers with over 2 million square feet of office space in the area. Pleasanton is also one of the top 10 school districts in California, making it an attractive community for families.

In an effort to meet the state mandated housing requirements, the city of Pleasanton adopted their 2023-31 Housing Element Plan in January 2023 which identifies sites available for redevelopment, including the Stoneridge Mall. Shopoff is exploring a variety of uses for the former retail space, including new housing, office and mixed-use retail.

Joseph Hanen, Praelium’s chief investment officer, added, “We are thrilled to announce the successful acquisition of another investment in partnership with Shopoff Realty Investments and Singerman Real Estate. At Praelium, we are confident in our ability to navigate the ever-changing real estate market, and we remain committed to finding new and exciting investment opportunities for our partners and investors.”

About Shopoff Realty Investments

Shopoff Realty Investments is an Irvine, California-based real estate firm with a 31-year history of value-add and opportunistic investing across the United States. The company primarily focuses on proactively generating appreciation through the repositioning of commercial income-producing properties, the entitlement of land assets and development projects. The 31-year history includes operating as Asset Recovery Fund, Eastbridge Partners and Shopoff Realty Investments (formerly known as The Shopoff Group). Performance has varied in this time frame, with certain offerings generating losses. For additional information, please visit www.shopoff.com or call (844) 4-SHOPOFF.

Disclosures

This is not an offering to buy or sell any securities. Such offer may only be made through the offerings memorandum to qualified purchasers. Any investment in Shopoff Realty Investments programs involves substantial risks and is suitable only for investors who have no need for liquidity and who can bear the loss of their entire investment. There is no assurance that any strategy will succeed to meet its investment objectives. The performance of this asset is not indicative of future results of other assets. Securities offered through Shopoff Securities, Inc. member FINRA/SIPC, 18565 Jamboree Road, Suite 200, Irvine, CA 92612, (844) 4-SHOPOFF.

About Praelium Commercial Real Estate

Orange County, California-based Praelium is a leading commercial real estate advisory firm, established in 2015. Praelium has successfully acquired and stabilized 5 million square feet of real estate. The company’s core approach is based on proprietary research, data-driven insights, and a laser focus on identifying exceptional commercial property investments, located in the Western and Southeastern regions of the United States.

About Singerman Real Estate, LLC

Singerman Real Estate, LLC (“SRE”) is a Chicago-based opportunistic real estate investment firm that has deep experience executing complex transactions and unlocking embedded value through the ownership of properties, real estate loans and operating companies. Currently, SRE is investing on behalf of SRE Opportunity Fund IV, L.P., a fully discretionary 2021 vintage investment vehicle with over $800 million of commitments and additional co-investment capacity through existing LPs of over $250 million. Since 2010, SRE has sourced and executed, with partners, over $4.7 billion of investments across major property types.