Year in Review – 2023

Bill Shopoff, President & CEO

Another year is coming to an end, and many in the real estate business will be saying good riddance to 2023. We had expected 2023 to be a choppy year, and the year did not disappoint in that regard.

The continued rate increases by the Federal Reserve have put tremendous pressure on commercial real estate, with transaction volume expected to finish this year down more than 70% from 2022 volumes. Shopoff Realty Investments (Shopoff) was not immune to the reduction in activity, although we feel fortunate to have completed several dispositions.

At the end of 2022, we had forecast dispositions and financing to total over $1.1 billion for the coming year. Instead, we will complete approximately $477 million in dispositions and financings. Additionally, we were forecasting over $200 million in acquisitions for 2023, and ended up closing just one acquisition of $16 million.

We continue to work on several acquisitions but have pushed their timing to 2024 while restructuring some of the transactions to adjust for market changes.

The challenges we encountered in 2023 were much the same as those that all real estate companies faced, led by the limited availability of financing. Lenders hesitated to lend or did so only on a restricted basis due to the uncertainty of future rate changes and the correlated determinability of future values. Lack of financing, interest rate increases, cap rate increases, and questions related to valuations resulted in a disconnect between buyer and seller expectations, which did not resolve itself during the year.

It appears the Fed’s war on inflation is making progress, and as I write this, we believe we may be at the peak of rate increases after twelve rate hikes. In fact market forecasts now anticipate a rate decrease by late Q1 or early Q2 2024.

There will be issues with loan maturities across all real estate market segments coming in 2024 and beyond. We believe multifamily assets can secure financing more easily, albeit at higher rates, than in the recent past, because the agencies (FNMA, Freddie Mac, & HUD) remain active. That said, proceeds will be less than previously available for office and retail assets, which will find a less favorable environment, as lenders are looking to reduce their exposure to such assets. Greenstreet has forecasted a debt funding gap of over $400 billion, given the values decline since the 2022 peak in pricing for office and retail assets. The silver lining is that a dramatic decline in development has largely kept supply in check.

World events continue to impact us here at home, with the Russian-Ukrainian war continuing and now the war in Gaza. These world conflicts continue to add to the turbulence in the financial markets, but the stock markets have been surprisingly resilient.

Despite all the market turmoil, we have not entered into a recession (at least not yet), and the economy has actually grown significantly this year. According to the Bureau of Economic Analysis, the third quarter GDP report showed the U.S. economy grew at a 5.2% annualized pace, the best mark since the fourth quarter of 2021. U.S. companies also hired about 2.5 million workers this year, and the unemployment rate is still hovering near 50-year lows; in nominal terms, the economy has grown by 25% since the pre-covid peak. Additionally, the 10-year treasury peaked at 4.98% in October, and is currently 4.43%.

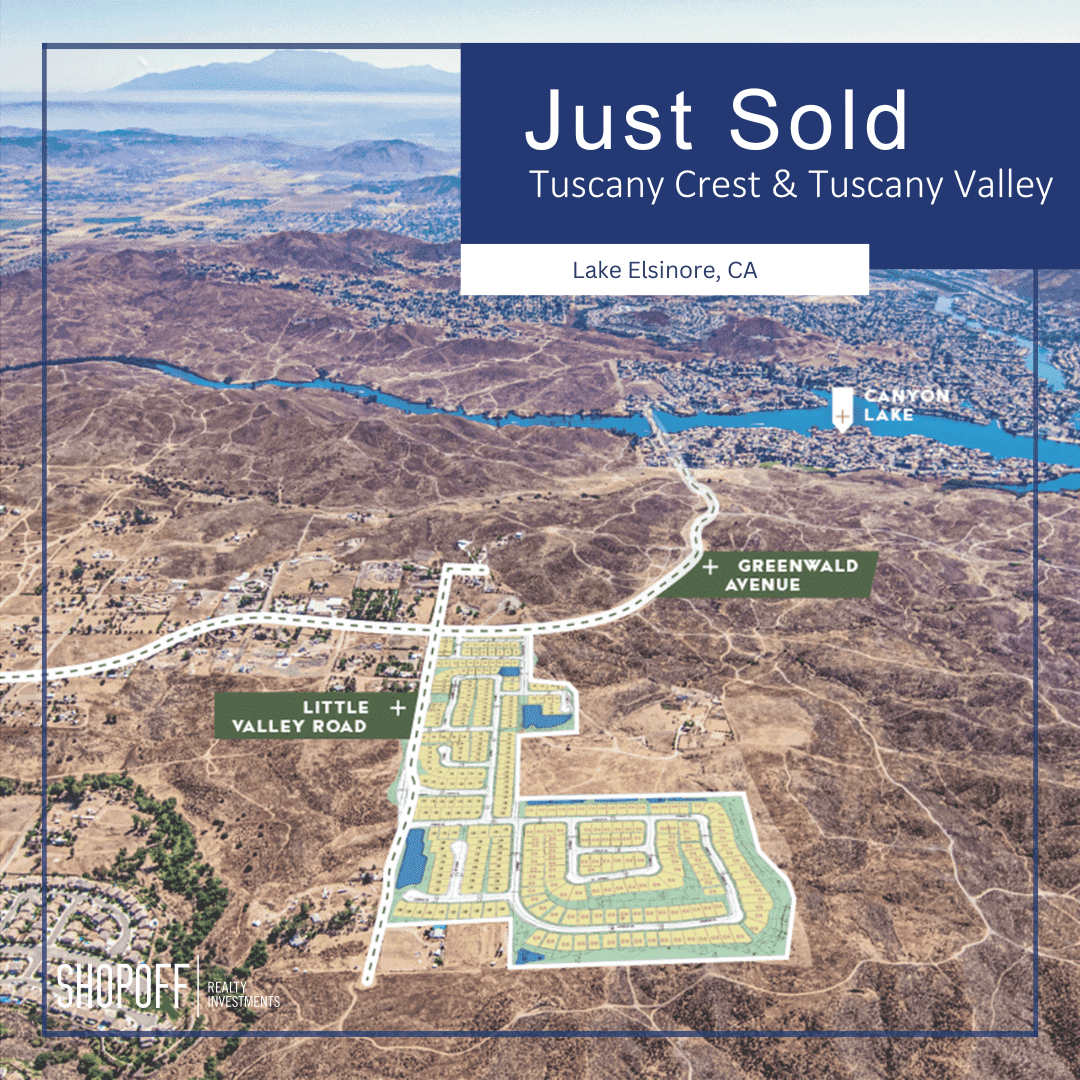

The new home market has been one of the surprises for 2023, as buyers have continued to support the market even with a dramatic increase in mortgage rates over the past 18 months. We see our builder clients continue to acquire lots to support continued demand. The low supply of resale houses has driven buyers to the new home market. Shopoff continues to seek opportunities for sites to develop new housing, focusing on retail and office sites to be redeveloped to fill housing demand.

Additionally, we remain bullish on long-term demand for industrial properties, supported by E-Commerce and onshoring of manufacturing. This will continue to drive demand for new development for several years to come, providing opportunities for us at Shopoff, given we have land for approximately 15 million square feet of development in California and Arizona markets.

As we had discussed in last year’s letter, we felt there would be buying opportunities for savvy investors. We would now add patience, in addition to savvy investors, as it has taken longer for the markets to adjust. That said, we expect pressure on sellers to accelerate as we move into 2024, creating opportunities for us to add to our portfolio at attractive pricing, and we look forward to reviewing additional opportunities in the new year.

We remain bearish on most, but not all, office buildings as many are functionally obsolete and have been adversely impacted by inflation or costs, with rental rates and occupancy declining in many markets. We expect a significant repricing in the asset class, with the only bright spot being in some higher-quality buildings in select submarkets, such as our building in Goleta, CA.

I remain grateful for Shopoff Realty Investments’ nearly 32 years in this business. Our quality team of dedicated employees at the firm has made my job enjoyable and intellectually stimulating. I would also like to thank the investors who continue to trust us and allow us to invest on their behalf. Lastly, I would like to acknowledge my wife and business partner, Cindy Shopoff. Cindy has decided to retire from her responsibilities at the end of the year. I am very appreciative of her and grateful for all we have built and accomplished over the firm’s three-plus decades. I look forward to shepherding the company for years to come, but I expect it will be different without my partner by my side on a daily basis.

The views, thoughts and opinions expressed in this outlook belong solely to the author. This outlook is based on current public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein are as of the date hereof and are subject to change without prior notification.

About Shopoff Realty Investments

Shopoff Realty Investments is an Irvine, California-based real estate firm with a 31-year history of value-add and opportunistic investing across the United States. The company primarily focuses on proactively generating appreciation through the repositioning of commercial income-producing properties and the entitlement of land assets. The 30-year history includes operating as Asset Recovery Fund, Eastbridge Partners and Shopoff Realty Investments (formerly known as The Shopoff Group). Performance has varied in this time frame, with certain offerings generating losses. For additional information, please visit www.shopoff.com or call (844) 4-SHOPOFF.

Disclosures

This is not an offering to buy or sell any securities. Such offer may only be made through the offering’s memorandum to qualified purchasers. Any investment in Shopoff Realty Investments programs involves substantial risks and is suitable only for investors who have no need for liquidity and who can bear the loss of their entire investment. There is no assurance that any strategy will succeed to meet its investment objectives. The performance of former assets are not indicative of future results of other assets. Securities offered through Shopoff Securities, Inc. member FINRA/SIPC, 18565 Jamboree Road, Suite 200, Irvine, CA 92612, (844) 4-SHOPOFF.